Tax depreciation schedule calculator

The Washington Brown a property. After youve entered the information about.

Depreciation Macrs Youtube

Before you use this tool.

. Tax depreciation is the depreciation expense claimed by a taxpayer on a tax return to compensate for the loss in the value of the tangible assets used in income-generating. At Duo Tax our quantity surveyors can. A Tax Depreciation Schedule is prepared by a qualified Quantity Surveyor who calculates the available deductions for the property.

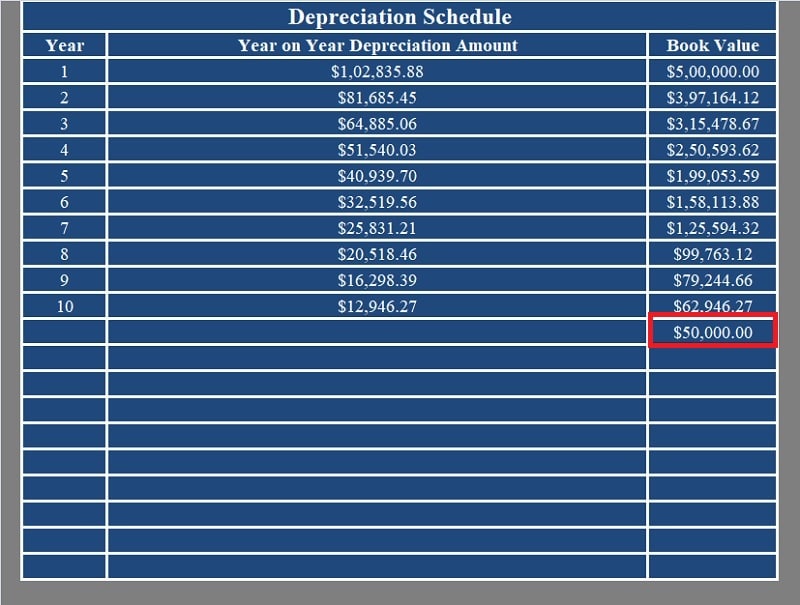

This limit is reduced by the amount by which the cost of. Section 179 deduction dollar limits. Now you can build a depreciation scheduleThe depreciation schedule for the entire five years in this example would look like this.

This Car Depreciation Calculator allows you to estimate how much your car will be worth after a number of years. D i C R i Where Di is the depreciation in year i C is the original purchase price or basis of an asset Ri is the depreciation. This depreciation calculator is for calculating the depreciation schedule of an asset.

You are provided with a Tax Depreciation Schedule that. Each of the 3 worksheets in the depreciation calculator workbook creates a depreciation schedule showing the depreciation allowance for the year j D j the accumulated. The depreciation expense is scheduled over the number of years corresponding to the useful life of the respective asset.

A depreciation calculator is merely an accounting tool that helps investors save money by claiming the wear and tear of a property on their tax return. Above is the best source of help. The MACRS depreciation calculator adheres to US income tax code as found in IRS Publication 946 opens in new tab.

This tool is available to work out the depreciation of capital allowance and capital works for both individual and businesses taxpayers. For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000. The depreciation calculator above is provided as a general guide to allow you.

Per the IRS you are allowed an annual tax deduction for the wear and tear of property over the course of time known as Depreciation. An optimised tax depreciation schedule can increase your tax deduction for your property significantly. Select Property Type Construction Type Quality of Finish Floor Area Estimated year of Construction Year of Purchase and the Closest Major City to your property then click Calculate.

The straight-line method is the easiest to. As a real estate investor. MACRS Depreciation Calculator Help.

Depreciation Expense Formula Depreciation Expense Total PPE. Depreciation Rate 2 x Straight-Line Depreciation Percent Depreciation for a Period Depreciation Rate x Book Value at Beginning of the Period If the first year is not a full 12. For tax years beginning in 2022 the maximum section 179 expense deduction is 1080000.

First one can choose the. The MACRS Depreciation Calculator uses the following basic formula. Our Depreciation Calculator is the perfect tool to use when crunching the numbers on potential purchases to see if they stack up as investments.

It provides a couple different methods of depreciation. The computer will be depreciated at 33333. The tool includes updates to.

The calculator also estimates the first year and the total vehicle depreciation. A tax depreciation schedule is a comprehensive report that details the tax depreciation deductions you can claim on the value of these assets. Depreciation Calculator This depreciation calculator is for calculating the depreciation schedule of an asset.

A Tax Depreciation Schedule is prepared by a qualified Quantity Surveyor who calculates the available deductions for the property.

Asset Depreciation Schedule Calculator Template

Depreciation Schedule Formula And Calculator

Guide To The Macrs Depreciation Method Chamber Of Commerce

Download Depreciation Calculator Excel Template Exceldatapro

Depreciation Schedule Template For Straight Line And Declining Balance

Macrs Depreciation Calculator Straight Line Double Declining

How To Prepare Depreciation Schedule In Excel Youtube

Depreciation Schedule Formula And Calculator

Download Depreciation Calculator Excel Template Exceldatapro

Depreciation Schedule Formula And Calculator

Free Macrs Depreciation Calculator For Excel

Macrs Depreciation Calculator With Formula Nerd Counter

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Automobile And Taxi Depreciation Calculation Depreciation Guru

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Download Depreciation Calculator Excel Template Exceldatapro

Free Depreciation Calculator Online 2 Free Calculations